-

-

-

-

-

-

-

-

-

-

3MIX FORUM

3MIX FORUMSIAM- I- AM (with apologies to Dr. Seuss)

Ro Shroff

Let’s cut to the chase. ICONSIAM, the 750,000sm, $1.7 billion Retail and Luxury Residential development on the Chao Phraya River in Bangkok that opened nine months ago, is by far, the best Retail and Leisure destination in the world today. Nothing in Vegas, Singapore or Dubai comes close to it. Keeping superlatives aside, this project exudes luxury, elegance, style, and history in a highly sophisticated way. More on that a little later.

Earlier this year I had the opportunity to visit Bangkok for a couple of days when it was still relatively less humid. As designers of commercial projects of all ilk, we are always looking for newer developments all over the world and evaluate what works and what doesn’t. While the quintessential two-story American version of the Shopping Center is essentially dead, the vertical Mall, or as euphemistically often referred to as Retail and Leisure Destinations in architectural jargon, is alive and kicking in Asia (and maybe even New York), where eight to ten story structures chock-full of fashion, fun and food are the norm. Get used to this idea, as there is more of this typology in the works all over Asia. ICONSIAM reinforces this model by seamlessly assimilating luxury brands, mid-market fashion, Thailand’s first Apple Store, a Takashimaya, a plethora of restaurants, cafes and bistros (over a 100 total), a 3,000 seat Auditorium and Exhibit Hall, a 14 screen state of the art Cineplex, a three-level grand Fitness Center and Spa, with Sook Siam, a Floating Market reinterpreted for an indoor environment as well as a Heritage Museum with permanent and temporary exhibits into an holistic eight-level structure cascading towards the riverfront and flanked by two luxury residential towers, The Magnolia Waterfront Residences (315m) and The Residences at Mandarin Oriental (270m). And a lushly landscaped River Park with landings for boats and the water taxi completes the waterfront setting.

Accessibility is still problematic but serendipitously mostly by water taxi for now, till the Skytrain station is completed next year. There is something for everyone here, for the nouveau riche Indian, Chinese and Saudi women spending mega bucks at the LVs, Pradas, and Fendis, to the millennials foraging the grand Zaras and H and M's, to the tech-savvy Apple faithful, to those with culinary aspirations, and the starry-eyed tourists and locals meandering through the cheesy but elegantly designed "Floating Market / Souk" offering street food and Thai delicacies, handicrafts, accessories, and dance performances …… a grand destination for every market segment without anyone intimidating the other.

Arrival is best by the water taxi, after sunset, as the exquisitely lit vertical glassy façade takes your breath away, exuding transparency and signature identities of the luxury brands. There is the ubiquitous Bellagio and Dubai Lake type synchronized fountain show welcoming and entertaining the visitors or those departing the center

Architecturally we have all seen better stuff, but the project does respond to its waterfront setting gracefully, cascading down to the third level deck outside the Foster-designed Apple Store with trees as partitions. The piece de resistance is the 24m high 300m long saw-toothed glass façade, an impressive engineering feat affording complete transparency, with panels fabricated in Germany and brought to the site on river barges. The signature icon at the summit of the glass facade seems to be a metaphoric Thai welcome gesture “Sawadee ka” presumably gilded in gold leaf. The architectural design is credited to Bangkok based Urban Architects Co. Ltd but regrettably, their website is of not much help and the project is not even mentioned. The Interior Design is credited to Benoy as the lead firm coordinating other specialized disciplines but it’s unclear whether the firm was involved till the end. But whoever designed the interiors, there seems to be a cohesive approach of careful detail, aggressive use of muted colors and textures including gold leaf, burnished stainless steel and fritted glass and the conception of several voluminous spaces. The sixth level food zone, Alangkarn, is appointed by 24 restaurants opening to Tassana Nakhon, the riverfront dining terrace. A vertical garden and a 20m high columnar waterfall compete favorably with the just-opened The Jewel at Singapore's Changi Airport. And a key aspect of the design is the phenomenal lighting design, both for the exuberant exterior and sparkling but non-intrusive interiors.

The Residential Towers are imposing in height but mostly non-descript architecturally and targeted for the uber-rich, with two-bedroom apartments selling for $2.5 million.

So why does just another Shopping Mall deserve a second look? This expose is not meant to be a gushing endorsement of a commercial and vanity project, but a clinical look at how such a setting and development can serve multiple agendas (cultural identity, profitability, and design nuance) simultaneously. The entire Retail industry is going through an urgent metamorphosis, countering the buying habits of millennials via e-commerce by making these destinations more visceral and experiential and less fashion-oriented. Whether it's ski-slopes, aquariums, waterparks, sports halls and mini stadiums with E-Sports, climbing walls and ice rinks, exhibit halls, exotic car showrooms, and mini-zoos, multiple food venues and marketplaces and megaplexes with 4D and 5G, “Experience” is IN.

Given ICONSIAM’s enormous price tag and dubious contribution to urbanity, a critical review is mandated from multiple viewpoints, whether those entail economic returns, exacerbation of the city’s notorious traffic, issues of public accessibility to the city’s waterfront, and the tremendous amount of energy consumed to keep everyone cool. On the plus side, it is also a product with a high level of taste and elegance providing much-needed waterfront open spaces, contributing to the city’s global identity and responding to sustainability initiatives by increased density.

There will certainly be detractors, if not from the architectural profession, then those from geopolitical and social pursuits, questioning the inordinate expenditure for a vanity project in a militarist government of an emerging economy already filled to the brim with retail centers. Whatever the viewpoints, it is a project worth a visit, whether as a casual tourist stop or as a review of a development that tells a convincing story and portends the future of these typologies.

(NOTE: The opinions expressed here are solely author's own)

#3MIX Forum#

-

-

-

-

-

-

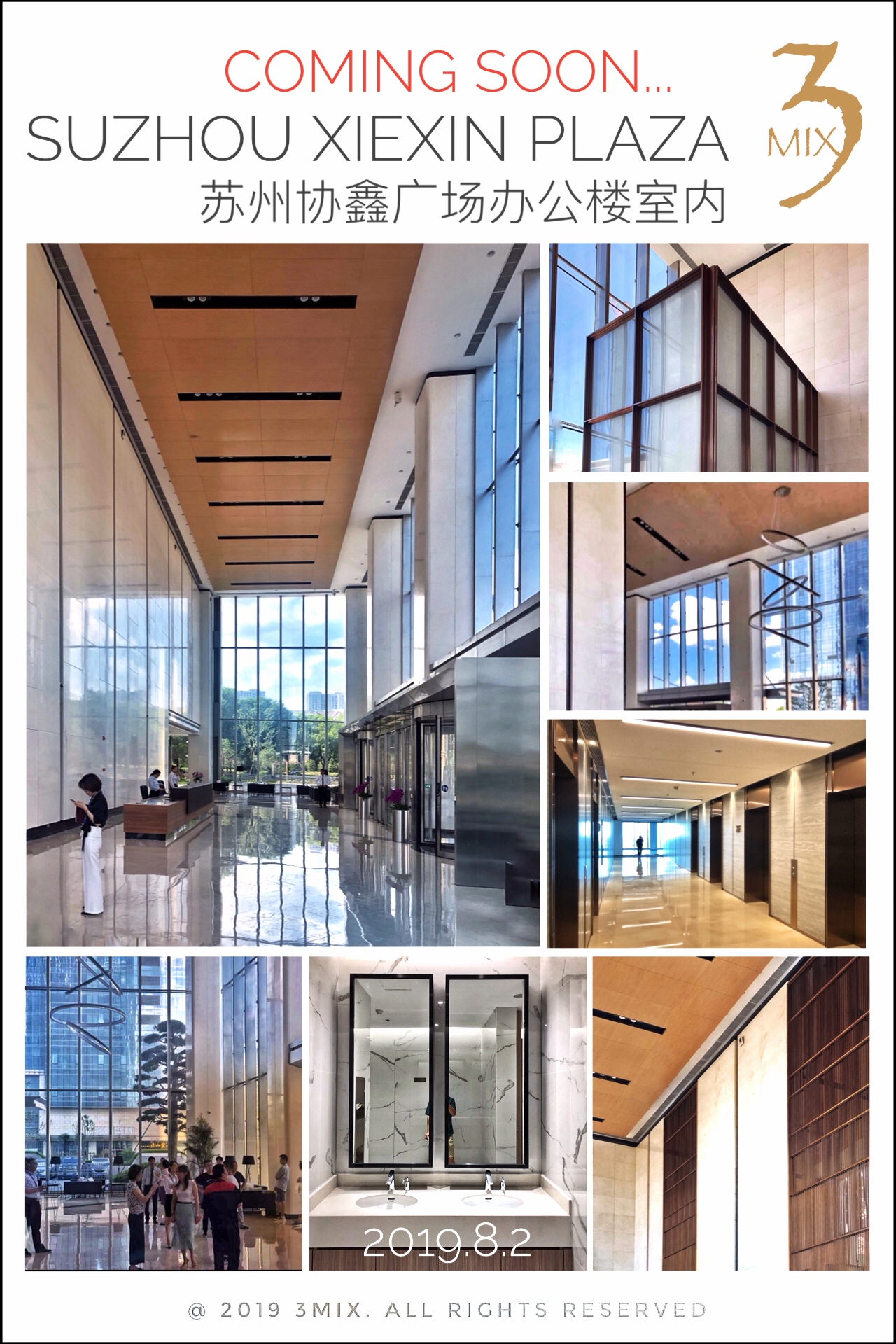

COMING SOON...

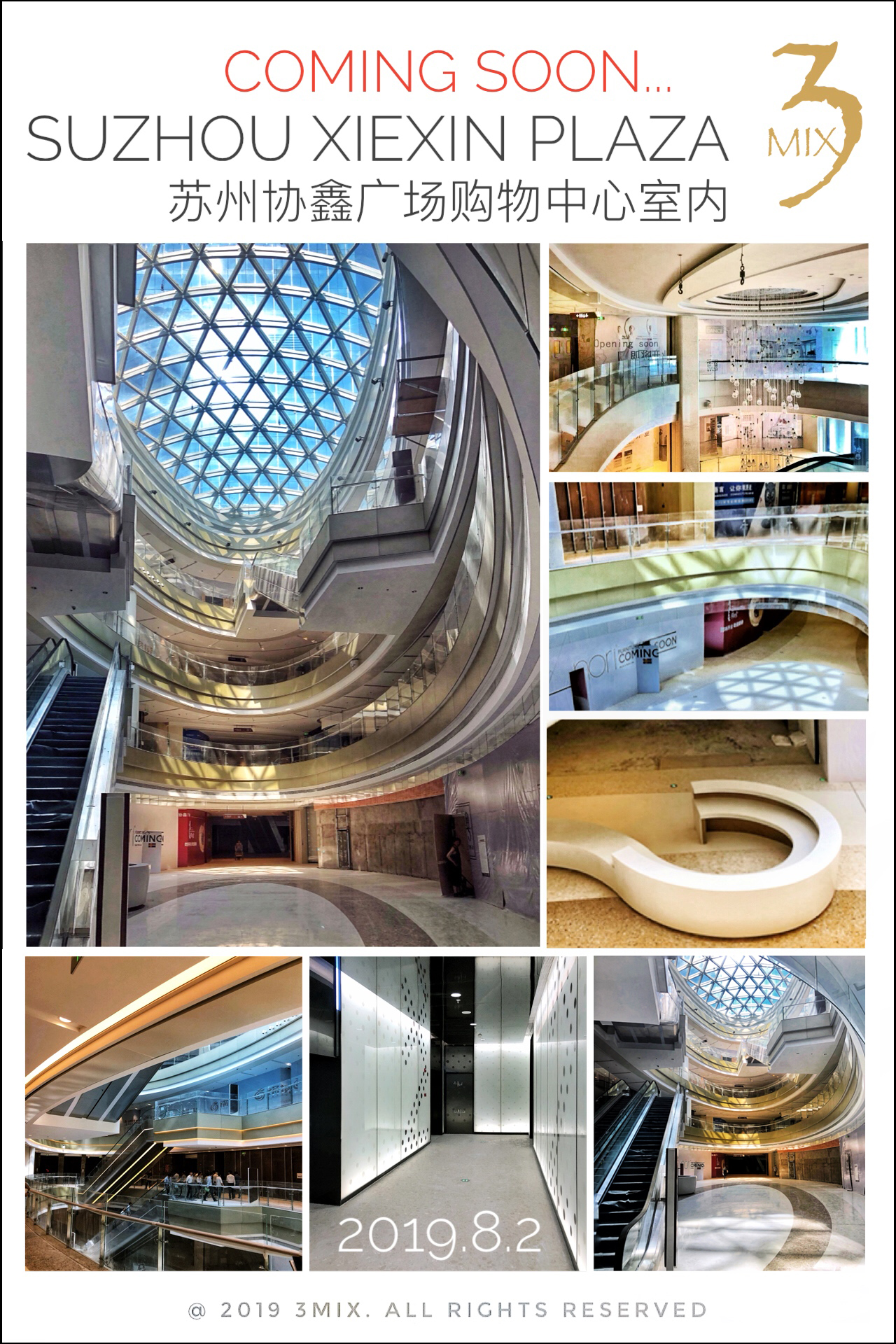

COMING SOON...

-