-

-

-

-

-

-

-

-

-

-

3MIX FORUMRo Shroff's article published in CTBUH Journal 2020_IssueIV

3MIX FORUMRo Shroff's article published in CTBUH Journal 2020_IssueIV

The Tall Building Strategically Reconsidered -

Seattle 2030: The Post-Crisis Tower

https://www.linkedin.com/pulse/tall-building-strategically-reconsidered-seattle-2030-ro-shroff/

#摩坛#

-

3MIX FORUM

3MIX FORUM

-

3MIX FORUM摩 • 坛

3MIX FORUM摩 • 坛

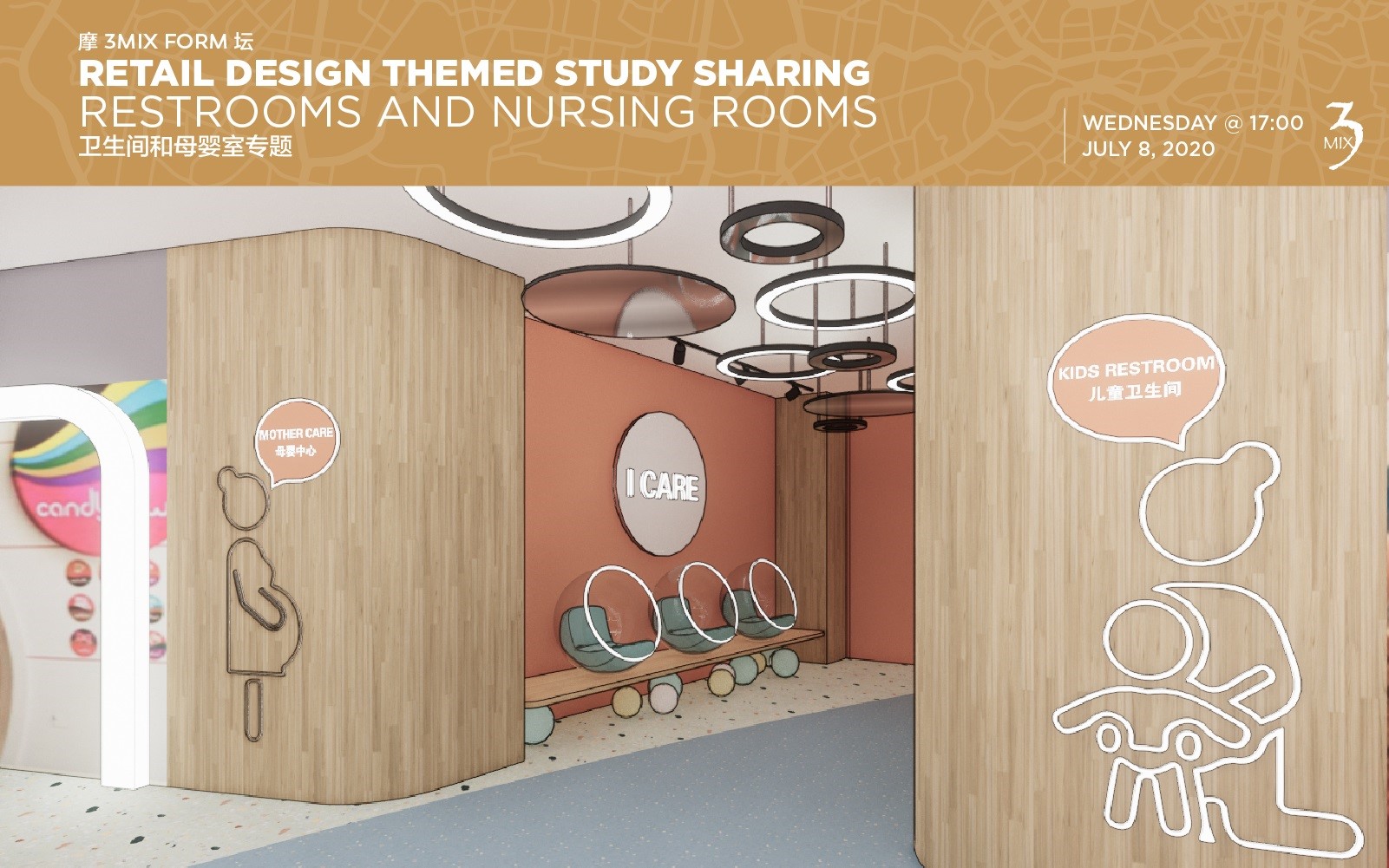

3MIX Today @ Five

Retail Design Themed Study Sharing

Restrooms and Nursing Rooms

卫生间和母婴室专题

#摩坛#

-

3MIX FORUM

3MIX FORUMNever Let a Good Crisis go to Waste

(Repost from :

https://www.linkedin.com/pulse/never-let-good-crisis-go-waste-ro-shroff/)

Societal Changes and their Economic Repercussions

Whether the above quote is attributable to Sir Winston Churchill or a version of it to Rahm Emanuel, the sentiment resonates even more during these weird times of Pandemics, social distancing, financial destruction, and death.If history is of any measure, this too will pass, and everyone will go back to their bad habits (compulsive handwashing may linger a while longer) as the New Normal arrives. But can this once in a lifetime event fundamentally change our DNA and societal habits? Probably not much immediately, but there will be enough residual collateral that will have major repercussions on our social lives as well as the global economic structure. The important thing is that we all learn something from this crisis. It will be a shame if life goes back to its carefree pre-Pandemic indifference and this entire personal and economic devastation has little or no residual effect.

So, what can we learn, predict and anticipate from this debacle and as Thought Leaders of the Built Environment (Architects, Planners, Interior Designers, and Engineers), what can we do to evolve things for the better?

Here are some suggestions, reflections, futurist ramblings and prognostications related to Personal and Public Space with each topic followed by a subjective ranking from 1 to 10, 10 being the worst-case scenario or an absolute occurrence.The Handshake may be a thing of the past

Sad! The firm handshake exuding warmth and confidence (Dude, you the man! indicative of raging machismo or Good to Reconnectindicative of Soft Power) may have seen its summit as well as nadir. There will no doubt be a reticence to engage in this societal nicety, as virus transmission fear will linger on for months, possibly years. So better get used to its absence. In the scheme of things, it's probably an insignificant loss, but it will be a shame if the substitute is a Wave of hands, a Namaste or the ridiculous Elbow Bump. Ah well! The price we pay for human connection and communication, but hey, we live in weird times.

Ranking: 7

Design and Economic Repercussions of Social Distancing

Will the 2m / 6’ apart “Social Distance” become a permanent norm or will it all evaporate once the Pandemic becomes a thing of the past? And if it continues and becomes the new normal, what repercussions will it have for Assembly type of venues (concerts, sports events, movie theaters, airplanes)? Will the airline industry have to rejig airplane seating and only sell every other seat (much like Business Class on any European Airline) and will movie theaters need to be redesigned to seat a maximum of 50 people instead of 100? The economic impact of this is going to be incalculable with the result that some venues like new Cineplexes and Sports Arenas will massively shrink in size as the majority of viewers resort to watching blockbusters and sports events in the comfort and safety of their own homes on their 60” QLEDs with personal Sensurround systems. “Go Big or Go Home” has a completely new meaning.

And another vestige of the previous era, the Shopping Mall, already going through an identity crisis, will redefine itself in new hybrid models infusing workplace and residential uses. Also, the fundamental DNA, size, and shape of such facilities will continue to evolve and morph into smaller venues and footprints. Fewer people go to these facilities today primarily to buy apparel or goods anyway, preferring e-commerce with next day delivery by Amazon or Alibaba. As it is, current and future designs are trending to go less on Fashion venues and more into the Experience-driven mode with mini arenas and climbing walls, basketball courts and fitness centers, showrooms and museums, urban farming and art workshops, expansive restaurants and the ubiquitous (although smaller) Cineplex. “Placemaking” initiatives, transit connectivity and inclusion of residential and hospitality components will continue to be absolute essentials.

The prognostication here is that, in time, all such facilities will eventually overlap, hybridize and blur into indecipherable nodes of activity and also shrink in size. It does not necessarily sound the death knell of the Urban Marketplace or Mall or Social Gathering Forums, just more targeted, compact, flexible and visceral urban environments, with a variety of uses but also with more surveillance and crowd control. All this also posits major conundrums for Developers and Designers if Social Distancing norms continue for a while. Economic repercussions of such change are potentially going to be enormous but also hard to predict. Assuredly smart minds will figure out ways of changing the dynamics and providing alternative avenues of profitability.Ranking: 5

There will definitively be a paradigm shift in the planning and design of the office space as we know it. The Pandemic forced everyone from New York to Shanghai, and Mumbai to Sydney to work and communicate remotely, share virtual celebratory events and maintain the obligatory distancing. This extreme isolation may have a reversal of sorts in the short term where everyone is starved of social connectivity (as the human being is ultimately a social animal) and the pent-up demand may see a short resurgence of life as we knew it. But the longer-term proposition may portend other priorities. This could manifest by the contraction of required physical environments and smaller real-estate investments for many organizations as may be up to 30% of the workforce may work remotely, from home, the neighborhood Starbucks or Timbuktu at any given time. And within the typical space, endless lines of “benching” or Dilbert style workstations will become an artifact of the industrial age. Assigned space will constitute maybe only half the total amount of available desks, the remainder being “hot desks” in industry jargon. This phenomenon itself is not yet universally accepted as a panacea either and there have been several vocal detractors within the industry, citing issues of belonging, visual and acoustic privacy. Also, new models of the Co-working and Collaborative Workplace (the WeWork debacle notwithstanding) will become more economically viable to corporations that are reticent to invest major funds in the constantly evolving arenas of work habits and physical spaces.

The bottom line is that the traditional Office Space as we know it will change considerably, with new models of future office buildings morphing into smaller configurations with clusters of reduced sized floor plates connected by common vertical cores and interspersed by sky decks and gardens promoting a biophilic approach to design. The current universally accepted models of hermetically sealed 2,000 sm / 20,000 SF floor plates with central cores may become an antique notion while smarter climate-sensitive façade systems, better indoor air quality, sophisticated and ultra-fast connectivity aided by 5G and No-Touch and Disease Prevention strategies will become de rigueur in the design process.

Ranking: 6

Ranking: 7

Conclusions

A word of caution and maybe even comfort. All this is not going to happen overnight. Built Environment industry Futurists and Thought Leaders expect the change to be relatively gradual, yet inevitable. It takes almost five years from initiating an idea, validating it, designing it, evolving new technologies and the plodding construction process itself. The process will be measured, but the paradigm shift is an absolute given.

There is always the danger of over-reaction and mandatory edicts. Being social animals, the need to congregate, fly to exotic destinations for pleasure or business, and enjoy a movie or ball game together is not suddenly going to go away or vanish. There will be incremental changes over time and possibly well-deserved, albeit for different reasons. But it’s doubtful if there will be a sea change in attitude or business in the near future.

All of this will also have huge economic repercussions and the Real Estate sectors globally will have to do a lot of strategic soul-searching in terms of returns and competitive pricing, which may go up even as the amount of space consumed is less.Prognostications, in a way, are easy to fabricate and have shock value (the new book After Shock, 50 years after Future Shock, is a must-read). No one saw the Coronavirus coming and it has been the proverbial Canary in the Coalmine, accelerating change and completely redefining aspects of life. Notwithstanding such Black Swans (metaphors that describe an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact, with the benefit of hindsight), life as we know it will go on as human beings are fundamentally resilient and malleable.

Change though is always Inevitable. The question, whether we embrace it and benefit by it remains to be seen.Ranking: 10

(NOTE: The opinions expressed here are solely author's own)

#摩坛#

-

-

3MIX FORUM

3MIX FORUMSIAM- I- AM (with apologies to Dr. Seuss)

Ro Shroff

Let’s cut to the chase. ICONSIAM, the 750,000sm, $1.7 billion Retail and Luxury Residential development on the Chao Phraya River in Bangkok that opened nine months ago, is by far, the best Retail and Leisure destination in the world today. Nothing in Vegas, Singapore or Dubai comes close to it. Keeping superlatives aside, this project exudes luxury, elegance, style, and history in a highly sophisticated way. More on that a little later.

Earlier this year I had the opportunity to visit Bangkok for a couple of days when it was still relatively less humid. As designers of commercial projects of all ilk, we are always looking for newer developments all over the world and evaluate what works and what doesn’t. While the quintessential two-story American version of the Shopping Center is essentially dead, the vertical Mall, or as euphemistically often referred to as Retail and Leisure Destinations in architectural jargon, is alive and kicking in Asia (and maybe even New York), where eight to ten story structures chock-full of fashion, fun and food are the norm. Get used to this idea, as there is more of this typology in the works all over Asia. ICONSIAM reinforces this model by seamlessly assimilating luxury brands, mid-market fashion, Thailand’s first Apple Store, a Takashimaya, a plethora of restaurants, cafes and bistros (over a 100 total), a 3,000 seat Auditorium and Exhibit Hall, a 14 screen state of the art Cineplex, a three-level grand Fitness Center and Spa, with Sook Siam, a Floating Market reinterpreted for an indoor environment as well as a Heritage Museum with permanent and temporary exhibits into an holistic eight-level structure cascading towards the riverfront and flanked by two luxury residential towers, The Magnolia Waterfront Residences (315m) and The Residences at Mandarin Oriental (270m). And a lushly landscaped River Park with landings for boats and the water taxi completes the waterfront setting.

Accessibility is still problematic but serendipitously mostly by water taxi for now, till the Skytrain station is completed next year. There is something for everyone here, for the nouveau riche Indian, Chinese and Saudi women spending mega bucks at the LVs, Pradas, and Fendis, to the millennials foraging the grand Zaras and H and M's, to the tech-savvy Apple faithful, to those with culinary aspirations, and the starry-eyed tourists and locals meandering through the cheesy but elegantly designed "Floating Market / Souk" offering street food and Thai delicacies, handicrafts, accessories, and dance performances …… a grand destination for every market segment without anyone intimidating the other.

Arrival is best by the water taxi, after sunset, as the exquisitely lit vertical glassy façade takes your breath away, exuding transparency and signature identities of the luxury brands. There is the ubiquitous Bellagio and Dubai Lake type synchronized fountain show welcoming and entertaining the visitors or those departing the center

Architecturally we have all seen better stuff, but the project does respond to its waterfront setting gracefully, cascading down to the third level deck outside the Foster-designed Apple Store with trees as partitions. The piece de resistance is the 24m high 300m long saw-toothed glass façade, an impressive engineering feat affording complete transparency, with panels fabricated in Germany and brought to the site on river barges. The signature icon at the summit of the glass facade seems to be a metaphoric Thai welcome gesture “Sawadee ka” presumably gilded in gold leaf. The architectural design is credited to Bangkok based Urban Architects Co. Ltd but regrettably, their website is of not much help and the project is not even mentioned. The Interior Design is credited to Benoy as the lead firm coordinating other specialized disciplines but it’s unclear whether the firm was involved till the end. But whoever designed the interiors, there seems to be a cohesive approach of careful detail, aggressive use of muted colors and textures including gold leaf, burnished stainless steel and fritted glass and the conception of several voluminous spaces. The sixth level food zone, Alangkarn, is appointed by 24 restaurants opening to Tassana Nakhon, the riverfront dining terrace. A vertical garden and a 20m high columnar waterfall compete favorably with the just-opened The Jewel at Singapore's Changi Airport. And a key aspect of the design is the phenomenal lighting design, both for the exuberant exterior and sparkling but non-intrusive interiors.

The Residential Towers are imposing in height but mostly non-descript architecturally and targeted for the uber-rich, with two-bedroom apartments selling for $2.5 million.

So why does just another Shopping Mall deserve a second look? This expose is not meant to be a gushing endorsement of a commercial and vanity project, but a clinical look at how such a setting and development can serve multiple agendas (cultural identity, profitability, and design nuance) simultaneously. The entire Retail industry is going through an urgent metamorphosis, countering the buying habits of millennials via e-commerce by making these destinations more visceral and experiential and less fashion-oriented. Whether it's ski-slopes, aquariums, waterparks, sports halls and mini stadiums with E-Sports, climbing walls and ice rinks, exhibit halls, exotic car showrooms, and mini-zoos, multiple food venues and marketplaces and megaplexes with 4D and 5G, “Experience” is IN.

Given ICONSIAM’s enormous price tag and dubious contribution to urbanity, a critical review is mandated from multiple viewpoints, whether those entail economic returns, exacerbation of the city’s notorious traffic, issues of public accessibility to the city’s waterfront, and the tremendous amount of energy consumed to keep everyone cool. On the plus side, it is also a product with a high level of taste and elegance providing much-needed waterfront open spaces, contributing to the city’s global identity and responding to sustainability initiatives by increased density.

There will certainly be detractors, if not from the architectural profession, then those from geopolitical and social pursuits, questioning the inordinate expenditure for a vanity project in a militarist government of an emerging economy already filled to the brim with retail centers. Whatever the viewpoints, it is a project worth a visit, whether as a casual tourist stop or as a review of a development that tells a convincing story and portends the future of these typologies.

(NOTE: The opinions expressed here are solely author's own)

#摩坛#

-

3MIX FORUM

3MIX FORUM

-